A FREE digital dashboard providing a safe, convenient place to store your income and expense evidence digitally.

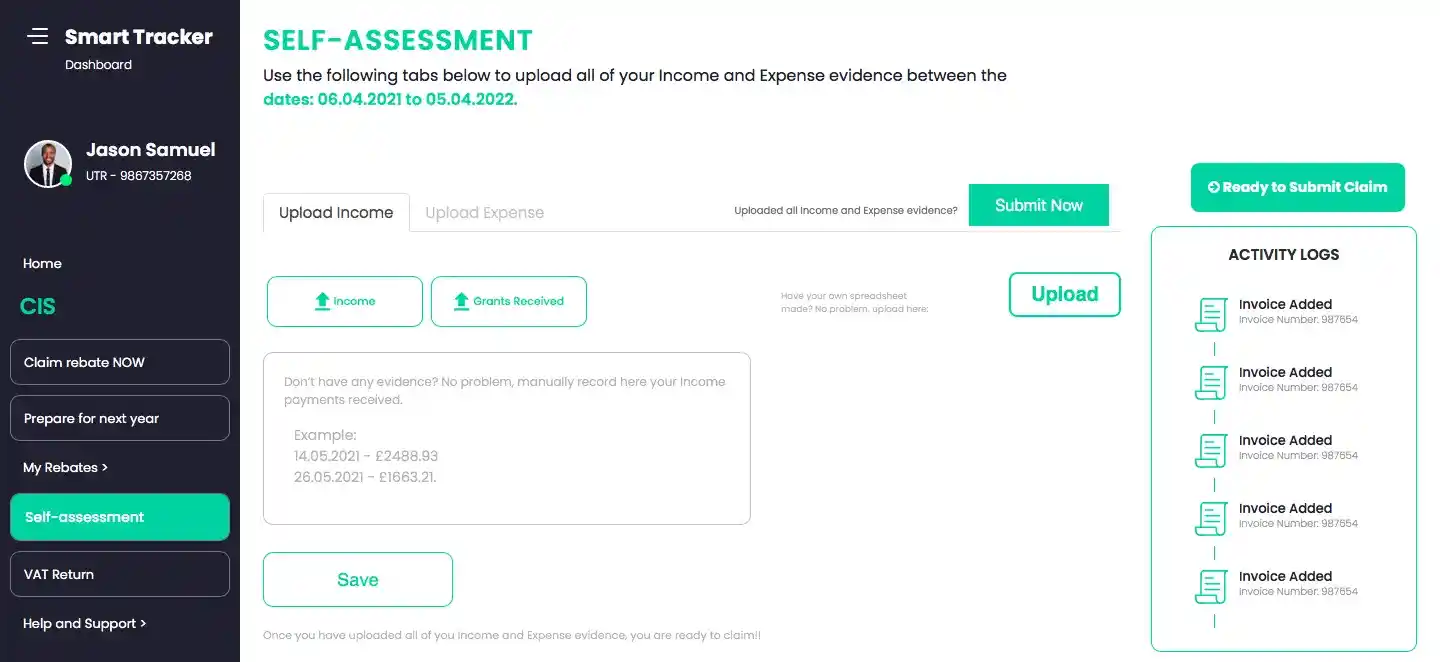

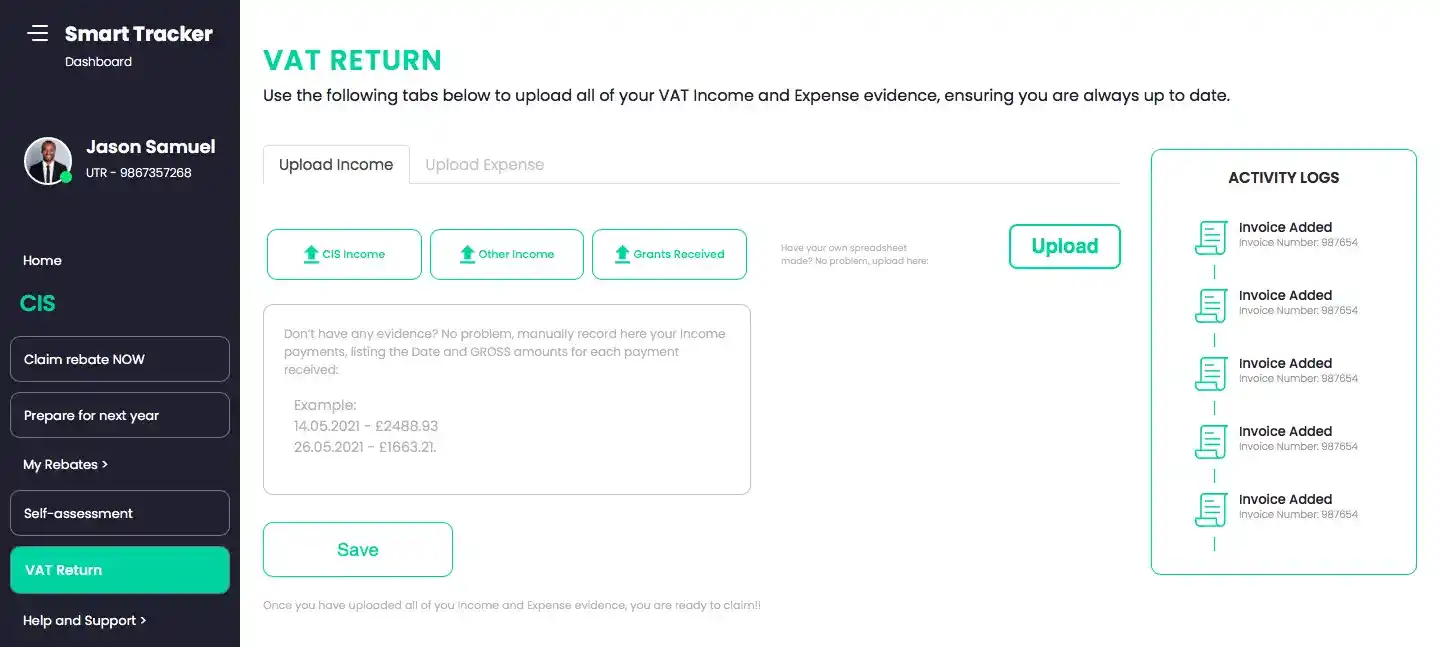

The Smart Tracker provides access for sole traders to prepare for their CIS tax return, Self-assessment annual return and/or quarterly VAT return. The user-friendly dashboard provides you with the ability to upload your income and expense evidence, for both this years tax return and in preparation for the following years tax return. Simply use your mobile phone to take pictures of your income documents and expense receipts and upload them to your smart tracker dashboard. You can also upload your bank statements or a spreadsheet (if applicable), making this a seamless process compared to traditionally taking a box full of documents in to your local accountant.

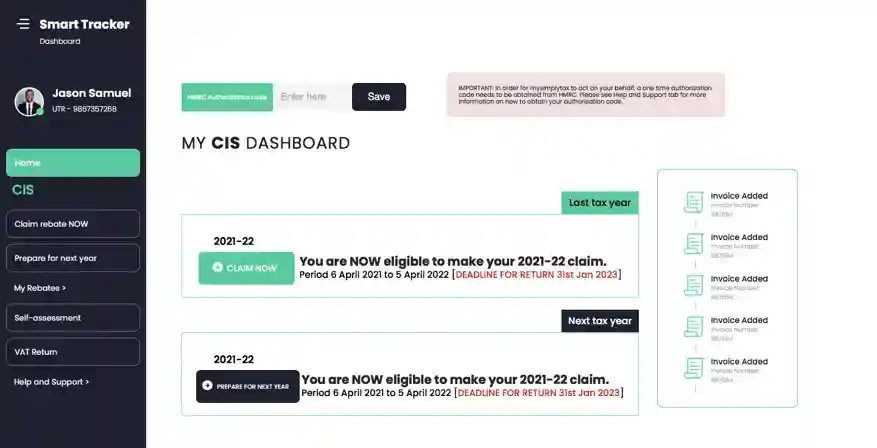

Quick and easy registration process, with automatic application to HMRC so that we can act on your behalf to complete your necessary returns.

This is your unique identity number relating to your personal tax and national insurance contributions. This can be found on any tax letter from HMRC (or previous payslip) and is made up of letters and numbers.

A Unique Taxpayer Reference, often referred to as a UTR or a UTR number, is a code used by HMRC to identify self-employed people and their companies for tax purposes. This can be found on any HMRC correspondence.

So that we can complete your self-assessments on your behalf, we require authorisation from you to act directly with HMRC. When you register with the Smart Tracker, we automatically apply for an authorisation code, which will be sent to you in the post within 7 days of registration. Simply login to the Smart Tracker, enter and save the code. The code begins ‘SA’ and is only required once in order for us to act on your behalf moving forward.